By Investment Associate Bobby Adusumilli, CFA.

In my opinion, investing is arguably the most competitive field in the world. With financial and technological innovations in recent decades, almost anyone in most developed countries with a sum of money can buy and sell public stocks, bonds, mutual funds, ETFs, and other financial instruments. Additionally, regardless of their occupations, many people invest through 401(k)s, 403(b)s, 457 plans, IRAs, taxable accounts, and / or a number of other financial accounts. Even if their primary occupations take up most of their time, these people are also investors.

With billions (or even trillions) of dollars in potential gains at stake, investing has become increasingly competitive as time has gone on. Thousands of investment firms across the country employ smart people and cutting-edge technology, all in the pursuit of achieving higher returns. As a result, investment market prices are constantly adjusting from the buy and sell orders of sophisticated parties, making it very difficult for someone to outperform the market.[1][2]

So what differentiates a great investor from the rest?

Over a series of recent newsletters and articles, financial journalist Jason Zweig (author of Your Money and Your Brain, as well helped Nobel Prize-winning psychologist Daniel Kahneman write the bestselling book Thinking, Fast and Slow) details what he believes are the seven virtues of great investors.[3] We share these virtues below, providing our own experiences with each.

Discipline

Discipline is about creating a well-thought-out investment process appropriate for you, and then following your rules.[4] Discipline also helps you get out of your own way, particularly in the tough times. In our experience, the more disciplined an investor is, the better their investment returns tend to be. As John Bogle writes in his book Bogle On Mutual Funds: New Perspectives For The Intelligent Investor, “Successful investing involves doing just a few things right and avoiding serious mistakes.“[5]

Curiosity

Curiosity is driven by wanting to understand the world, wanting to get closer to what is true.[6] By being curious enough to understand what investment strategies work and why, you can potentially help yourself become a better investor.

Skepticism

Skepticism requires focusing on your foundational principles, and questioning arguments that differ from these principles.[7] For example, research demonstrates that most stock market investors underperform total stock market index funds, particularly over the long-term.[1] If someone tries to pitch you an investment that they say will outperform the stock market, and there is not enough good theory and evidence to back up their claim, then we would strongly caution you against purchasing that investment.

However, skepticism is not the same as pessimism. Skepticism also calls for open-mindedness when theory and evidence support a particular argument. As Howard Marks writes in his book The Most Important Thing, “Skepticism calls for pessimism when optimism is excessive. But it also calls for optimism when pessimism is excessive.“[8]

Independence

Independence means doing the right thing.[9] If others are doing the right thing, then independence doesn’t mean that you have to be alone. But if others around you are doing something that doesn’t align with your principles and investment strategy, then being independent means having the courage to stick with your investment plan, even if that means going against the crowd.

Humility

Humility means understanding the reality of your situation, not deceiving yourself.[10] Humility recognizes that you don’t control and know everything. As an investor, there will be times when you underperform others around you, and there will be times when you outperform. In our experience, performance is always subject to some degree of luck. Humility also means that there will be someone more successful at investing than you, and recognizing that that is okay as long as you have a sound investment strategy in place and you are making progress towards your goals.

Patience

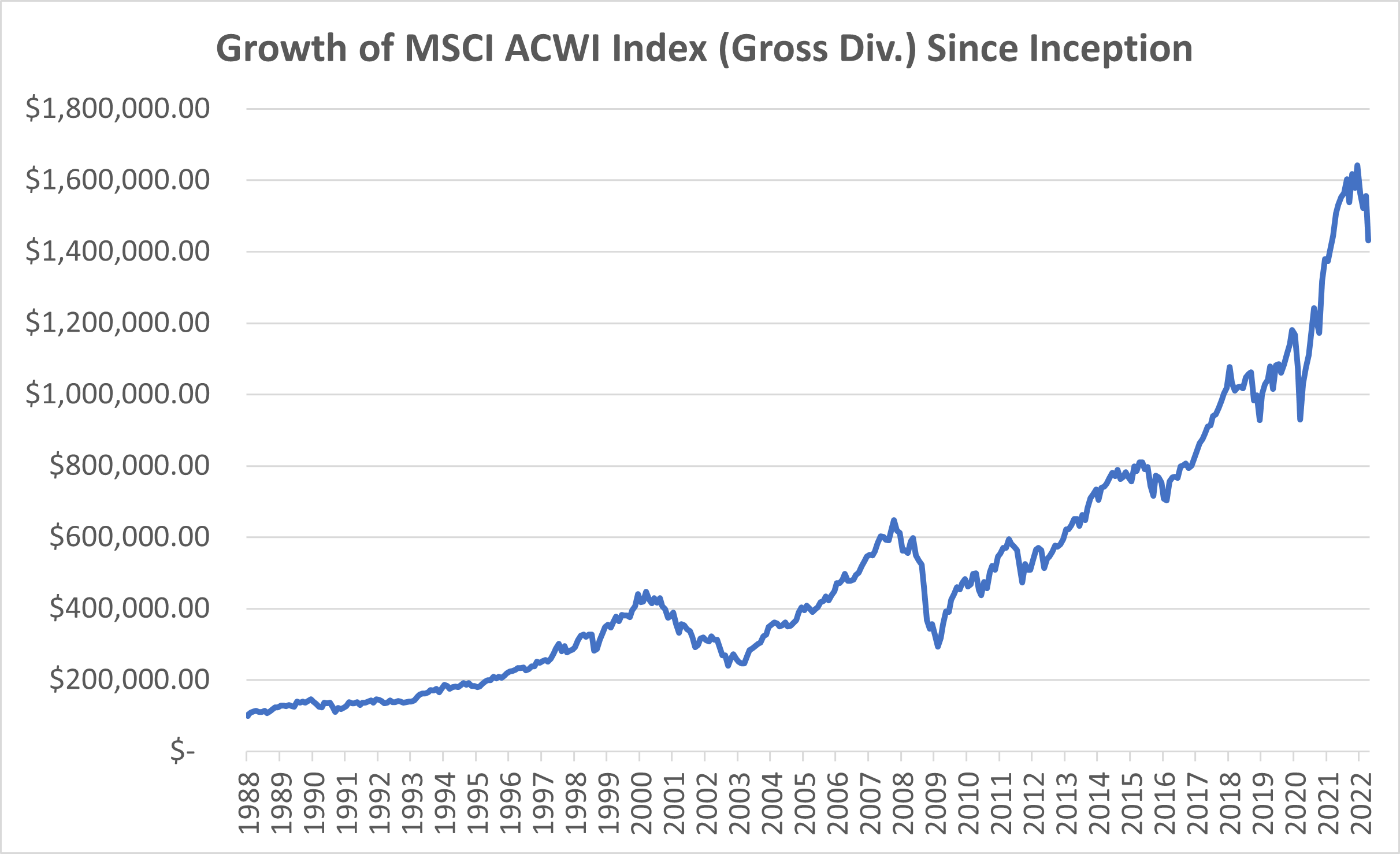

The longer you invest, the more time you are giving your investments to potentially grow, as the graph at the bottom of this article demonstrates.[11] While each investor has different circumstances and goals, in our experience, many of the best investors give themselves as much time as possible to grow their money; they have the patience to have the longest view in the room.

Courage

It is hard to be a great or even good investor. It is hard to continue investing when the market is going down, and it is hard to be disciplined enough to stick with your investment strategy when other strategies are booming.[3] If you create a well-thought-out investment plan backed by theory and evidence, then in our experience, having the courage to stick to your investment plan in both good times and bad tends to work out for people in the long run.

So What Can You Do To Become A Great Investor?

Research shows that the vast majority of stock market investors underperform the stock market, with greater underperformance as the period of time studied is lengthened.[1] While there are some people who outperform for a period of time, it is very hard to know who these people are in advance. Even if you know who they are, as the period of time increases, some of these great investors no longer achieve the same level of outperformance.

So what can you do to become a great investor? One strategy is to aim to be an above-average investor each year for a very long period of time. For example, research shows that just owning the stock market through an index fund will help you outperform most investors in most years as well as over time.[1] For example, if you had been able to own the global stock market as measured by the MSCI ACWI Index from 1988 (the index inception) through April 2022 (assuming reinvestment of all distributions; no other expenses or taxes considered), an initial investment of $100,000 would have grown to over $1,400,000. While the definition of a great investor is ambiguous, this performance seems like a great outcome to me.

Source: Dimensional Returns Web. See Important Disclosure Information.[12]

While future performance will differ from past performance, and while it was more difficult to invest in global investment strategies in the past, investors today have the ability to nearly match many global stock and bond indices even after considering fees.[13] Therefore, we believe that investing in low-cost, low-turnover, broadly-diversified global mutual funds and ETFs is a sound investment strategy that can potentially help a lot of people over the long-term.[14] And if you stick with a sound investment strategy long enough, you may become a great investor yourself.

Important Disclosure Information & Sources:

[1] “2022 Quantitative Analysis of Investment Behavior Report”. DALBAR, 2022, dalbar.com.

[2] “Why Do Investors Underperform?“ Bobby Adusumilli, 24-Jun-2021, sjsinvest.com.

[3] “The Secret to Braving a Wild Market“. Jason Zweig, 02-Mar-2022, wsj.com.

[4] “2020: The Sequel?“ Jason Zweig, 12-Jan-2022, The Intelligent Investor Newsletter - wsj.com.

[5] “Bogle On Mutual Funds: New Perspectives For The Intelligent Investor“. John Bogle, 2015, Wiley Investment Classics.

[6] “'The First Great Investing Virtue“. Jason Zweig, 19-Jan-2022, The Intelligent Investor Newsletter - wsj.com.

[7] “A New Month, A New Market?“ Jason Zweig, 08-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[8] “The Most Important Thing: Uncommon Sense for the Thoughtful Investor“. Howard Marks, 2011, Columbia Business School Publishing.

[9] “Stepping Away from the Herd“. Jason Zweig, 15-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[10] “On Humility and Independence“. Jason Zweig, 22-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[11] “Patience Amid Turbulence“. Jason Zweig, 02-Mar-2022, The Intelligent Investor Newsletter - wsj.com.

[12] The MSCI ACWI Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets, consisting of 47 country indices comprising 23 developed and 24 emerging market country indices. Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

[13] “Index funds“. Vanguard, vanguard.com.

[14] “MarketPlus Investing“. SJS Investment Services, sjsinvest.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.