By Founder & CEO Scott Savage.

Increasingly, this is a question that is posed to the SJS Team: Should I buy bitcoin?

While bitcoin and other cryptocurrencies have risen dramatically in price over the past ten years, most of the ideas underlying cryptocurrencies are not all that new, and cryptocurrencies are not as complicated as they may appear to be.[1] To help you better understand cryptocurrencies, we provide a short history, potential benefits, concerns, and how your portfolio can possibly benefit from cryptocurrencies.

History Of Cryptocurrencies

The idea behind a digital currency is not new. Starting around the 1980s, many individuals have attempted to create a digital currency, with each breakthrough building on top of past breakthroughs.[2] For example, in its early years, PayPal (which also now owns Venmo) was driven by the “idea of creating a new digital currency to replace the U.S. dollar.”[3] Technology and the internet have allowed for transactions to become faster, more secure, and lower cost. Many people in the US today don’t even use paper cash today, meaning the U.S. dollar already feels like a digital currency for them.

In 2008, another breakthrough occurred: an unknown person or team named Satoshi Nakamoto outlined a new cryptocurrency called bitcoin in a white paper, calling bitcoin, “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.“[4] Simply put, bitcoin is digital money that securely allows people to transact over the internet, without needing a bank or traditional financial intermediary involved.

Bitcoin’s single biggest innovation is the blockchain, which is the technology underlying bitcoin that allows for all historical transactions to be recorded for anyone around the world to access at any time. The blockchain also allows for transactions to happen almost instantaneously, securely, in a relatively low-cost manner, and be verified by anyone around the world.

21 million bitcoin is the maximum number of bitcoin that will ever be created.[4] Today, there are roughly 19 million bitcoin outstanding, and the remaining 2 million will be “mined” over the next 100+ years to compensate people for ensuring the accuracy of the blockchain.[4][5] You can own fractional interest of one bitcoin. In 2011, the price of one bitcoin exceeded $1 US dollar; by April 2022, the price of bitcoin is around $40,000 US dollars, meaning the total value of all bitcoin in existence today is roughly $750 billion.[5]

As with any lucrative technology, bitcoin and the blockchain have given risen to thousands of other cryptocurrencies and related digital assets. While we believe the vast majority of these digital assets won’t have value over the long-term, another cryptocurrency called Ethereum has made significant innovations building off of bitcoin, which is why it has become the second most valuable cryptocurrency behind bitcoin.[6]

If you would like more information on the history of bitcoin and cryptocurrencies, we recommend the book Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money by Nathaniel Popper.

Potential Benefits Of Cryptocurrencies

Transparency: Bitcoin is designed to be transparent, in efforts to limit the ability for a group of people or institutions to manipulate both bitcoin and the blockchain.

Limited amount of currency: Bitcoin and some other cryptocurrencies limit the amount of currency that will exist in the future. Many supporters believe this will help these cryptocurrencies serve as a store of value (this is why bitcoin is sometimes referred to as “digital gold”) as well as protection from inflation.[6] This is a major positive factor for people who are worried about governments printing money to pay off debts, which would devalue those currencies.[6]

Ability to hold around the world: Particularly for people who live in countries with volatile currencies or who move around the world, owning cryptocurrencies can be significantly more stable and secure for them compared to holding the local currencies.

Lower transaction costs: Cryptocurrencies may be able to help lower financial transaction fees over time. For example, many individuals in developing countries have to pay significant transaction fees in order to wire money to the US. Bitcoin can potentially reduce these transaction fees. Additionally, many people hope that the blockchain will help to lower (or even eliminate) credit card fees over time.

Privacy: Each bitcoin has a public key and a private key. Someone needs to use their private key (a long string of numbers and letters) in order to initiate a transaction. During a transaction, the public key is used by others on the blockchain to verify transactions. Both public and private keys are not associated with a person’s name, so as long as people don’t know that you own the private key and public key, then this can help to limit the chances that they will learn that you own that bitcoin.

Increasing adoption: Both individuals as well as institutions have been increasingly adopting the two largest cryptocurrencies (bitcoin and Ethereum) over the last few years.[7]

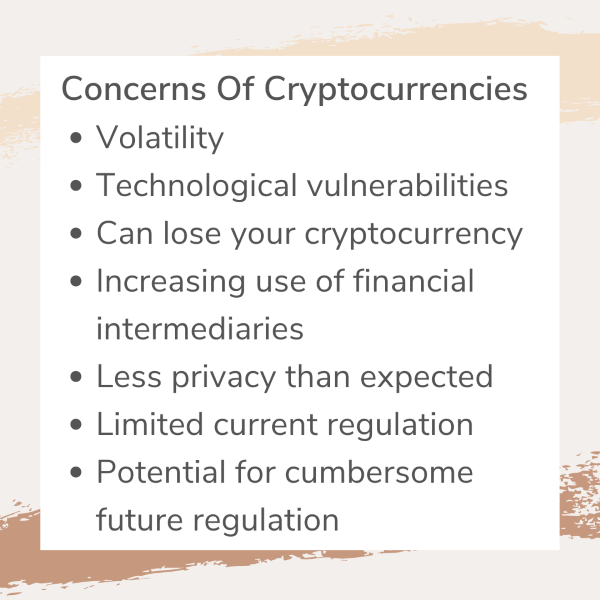

Concerns Of Cryptocurrencies

Volatility: Historically, even the largest cryptocurrencies have been highly volatile in price.[5] While this volatility is expected to decrease with increasing adoption, the volatility limits usefulness as an actual day-to-day currency.

Technological vulnerabilities: Cryptocurrencies and exchanges are subject to security risks, operational shutdowns, and hackers. For example, the Wall Street Journal estimates that approximately $3.2 billion worth of cryptocurrency was stolen in 2021.[8] However, the largest risks often impact newer and less-adopted cryptocurrencies and exchanges. In the coming years, the technology and infrastructure for the largest cryptocurrencies such as Bitcoin and Ethereum will become more robust, and hackings may become less common as a result.

Can lose your cryptocurrency: If you have a private wallet not affiliated with a major exchange, then if you lose your private key, you may potentially lose your cryptocurrency forever. For example, the New York Times recently estimated that nearly 20% of the total Bitcoin outstanding has been lost or is in stranded wallets.[9]

Increasing use of financial intermediaries: People and institutions are increasingly using financial intermediaries to store their cryptocurrencies.[7] This trend is in contrast to the initial vision for bitcoin.[4]

Less privacy than expected: Some people and institutions may not be able to achieve the level of privacy that they are hoping for with cryptocurrencies. For example, due to Russia’s war with Ukraine in 2022, Coinbase announced that it would block nearly 25,000 Russian-linked accounts (addresses) believed to be engaging in illicit activity, and governments around the world are also trying to seize Russian-linked cryptoassets.[10][11]

Limited current regulation, and potential for cumbersome regulation in the future: So far, regulation in countries around the world has lagged the growth of cryptocurrencies. However, governments are increasingly prioritizing regulation for cryptocurrencies, which could lead to uncertain effects. For example, China (which is expected to become the largest economy in the world by around 2030) has banned citizens from transacting in cryptocurrencies.[12] Additionally, the United States has not allowed for cryptocurrencies to be held directly in mutual funds and ETFs.[13] How will future regulation impact the value of cryptocurrencies?

How Can Your Portfolio Potentially Benefit From Bitcoin?

Market prices are driven by supply and demand. There is large and increasing demand for cryptocurrencies, and therefore we believe that cryptocurrencies are here to stay.

However, we don’t know what the aggregate market capitalization of cryptocurrencies will be, nor do we know how quickly cryptocurrencies will grow or decline, nor which ones will flourish and which ones will cease to exist. Bitcoin doesn’t have any earnings and doesn’t pay dividends, so we can’t value it like stocks.

What we do know is that cryptocurrencies have been quite volatile, and many clients are not comfortable investing in them. Additionally, for people who don’t do their homework, we view their buying of bitcoin as speculation, not investing.

Therefore, we do not invest client assets directly into cryptocurrencies. However, there are other ways to benefit from potential growth in cryptocurrencies. For example, there is an expansive options market for bitcoin where people and institutions do everything from speculating to hedging to achieving indirect exposure. In alignment with our view that cryptocurrencies are here to stay, we believe there are positive expected returns available in providing capital to the bitcoin options market. It is very complicated; we rely on an investment manager who has extensive experience with this market as part of a diversified alternatives mutual fund.[14] Additionally, due to their exposures to cryptocurrencies, some of the underlying stocks in the mutual funds and ETFs that we recommend may benefit from potential growth in cryptocurrencies.

The Ancient Chinese proverb famously says, “The best time to plant a tree was 20 years ago. The second best time is now.” When it comes to speculating in bitcoin, I would urge caution when applying this proverb to anything other than trees!

Important Disclosure Information & Sources:

[1] “Total Cryptocurrency Market Cap“. CoinMarketCap, 22-Apr-2022, coinmarketcap.com.

[2] “Cryptocurrency“. Wikipedia, wikipedia.org.

[3] Zero to One: Notes on Startups, or How to Build the Future. Peter Thiel & Blake Masters, 2014, Currency.

[4] “Bitcoin: A Peer-to-Peer Electronic Cash System“. Satoshi Nakamoto, 2008, bitcoin.org/en.

[5] “Total Circulating Bitcoin“. Blockchain, 22-Apr-2022, blockchain.com.

[6] Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money. Nathaniel Popper, 2016, Harper Paperbacks.

[7] “Our Thoughts on Bitcoin“. Ray Dalio & Rebecca Patterson, 28-Jan-2021, bridgewater.com.

[8] “Cryptocurrency-Based Crime Hit a Record $14 Billion in 2021“. Mengqi Sun & David Smagalla, 06-Jan-2022, wsj.com.

[9] “Lost Passwords Lock Millionaires Out of Their Bitcoin Fortunes”. Nathaniel Popper, 14-Jan-2021, nytimes.com.

[10] “Using Crypto Tech to Promote Sanctions Compliance“. Paul Grewal, 06-Mar-2022, coinbase.com.

[11] “The hunt for Russian crypto is on“. Benjamin Pimentel, 08-Mar-2022, protocol.com.

[12] “What's behind China’s cryptocurrency ban?“ Francis Shin, 31-Jan-2022, weforum.org.

[13] “SEC Delays Decision on Bitcoin ETFs Again“. Chitra Somayaji, 23-Jun-2021, wsj.com.

[14] “Stone Ridge 2020 Shareholder Letter“. Ross Stevens, 2020, stoneridgefunds.com/?tab=srdax.

Other resources that influenced this blog post.

“Cryptoassets: The Guide to Bitcoin, Blockchain, and Cryptocurrency for Investment Professionals“. Matt Hougan & David Lawant, 07-Jan-2021, cfainstitute.org/en.

“Why Bitcoin Matters“. Marc Andreesen, 11-Jan-2014, nytimes.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.