By SJS Investment Services Chief Investment Officer Tom Kelly, CFA.

The adage “Cash is King” has been used in investing to highlight the value of holding on to cash to both protect an investor from having to withdraw when the markets are down, as well as the ability to deploy cash and purchase when prices become cheaper. However, over the last decade, with interest rates kept low near the anchoring Fed Funds rate, inflation has outpaced the interest rate on cash, leading to that cash losing its spending power over time.[1]

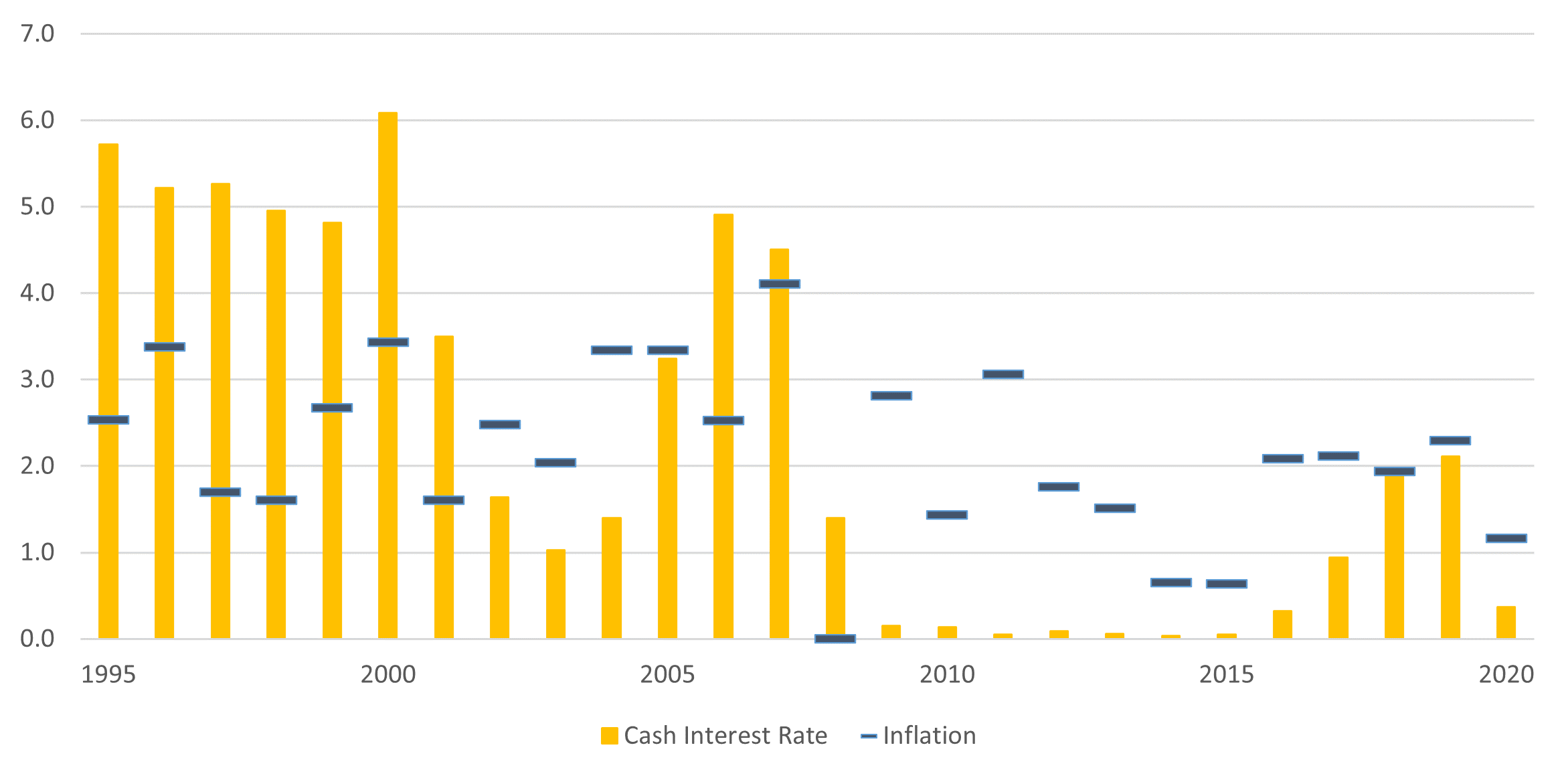

In the US, the erosion of cash value has been greater in recent times than previous periods, with cash trailing inflation since 2009, seen below. We believe this trend is likely to continue, with the Federal Reserve indicating they will continue to keep interest rates near 0%, all the while continuing to provide stimulus to the economy, leading to a 5-Year Breakeven Expected Inflation Rate of 2.35% as of February 23, 2021.[2][3]

Source: Morningstar. Cash represented by the US Treasury T-Bill Secondary Market 3 Month Rates. Inflation represented by the US Bureau of Labor Statistics Consumer Price Index All Urban Seasonally Adjusted Index. See Important Disclosure Information.[4]

Cash management remains vital to both risk mitigation and capital preservation. How can you increase your expected return via cash-like holdings? Online banks sometimes offer higher savings account interest rates than traditional banks due to their lower fixed physical costs. Depending on the holding time horizon, cash alternatives may include Treasury Inflation-Protected Securities (TIPS) or other higher-quality short-term bonds. Furthermore, both real estate and stocks have historically significantly outperformed inflation over the long-term, though they typically add significantly more volatility over the short-term.[5]

Prudent cash management can add incremental value to your overall portfolio investment return. If you have any questions regarding your cash management, please feel free to reach out to us.

Important Disclosure Information And Sources:

[1] “How Inflation Affects Your Savings Account.“ Justin Pritchard, 07-Jan-2021, thebalance.com.

[2] “Powell Pledges to Maintain Fed’s Easy-Money Policies Until Economy Recovers.” Paul Kiernan, 24-Feb-2021, wsj.com.

[3] “5-Year Breakeven Inflation Rate.” Federal Reserve Bank of St. Louis, 23-Feb-2021, fred.stlouis.org. The breakeven inflation rate represents a measure of expected inflation derived from 5-Year Treasury Constant Maturity Securities and 5-Year Treasury Inflation-Indexed Constant Maturity Securities. The latest value implies what market participants expect inflation to be in the next 5 years, on average. See Important Disclosure Information.

[4] The US Treasury T-Bill Secondary Market 3 Month Rates are the daily secondary market quotation on the most recently auctioned Treasury Bills for the 13 week maturity for which Treasury currently issues new Bills. Market quotations are obtained at approximately 3:30 PM each business day by the Federal Reserve Bank of New York. The rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year.

The US Bureau of Labor Statistics Consumer Price Index All Urban Seasonally Adjusted is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers. This particular index includes roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force.)

[5] Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies. Jeremy Siegel, 2014, McGraw-Hill Education.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

Statements contained in this post that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.