How Will Inflation Impact Your Portfolio?

History and Signaling Suggest Both Inflation and Interest Rates Will Remain Low

By SJS Investment Associate Bobby Adusumilli.

The Federal Reserve of the United States of America (the Fed) has a dual mandate: to maximize employment and to stabilize prices for goods and services. To pursue this mandate, the Fed believes that a 2.00% increase in annual inflation is most appropriate in the long run.[1]

While the Fed cannot completely control inflation, the Fed influences inflation by setting a target Federal Funds Rate (the rate at which banks borrow money from the government) and more directly changing the amount of money circulating in the economy in order to push the current Federal Funds Rate to the desired rate.[1] Consequently, while the Fed doesn’t directly control most other interest rates, shorter-term interest rates (< 1 year) generally follow changes in the Federal Funds Rate, and longer-term interest rates (>= 10 years) tend to follow as well (though with more variability).[2]

Source: “A Look at the Fed’s Dual Mandate.” Federal Reserve Bank of St. Louis, 08-Aug-2018, stlouisfed.org.

When inflation is higher (lower) than the Fed targets, the Fed will typically aim to decrease (increase) the money supply in the economy, which consequently typically increases (decreases) both the Fed Funds Rate and other interest rates, with the goal for individuals to spend less (more) and save more (less).[1]

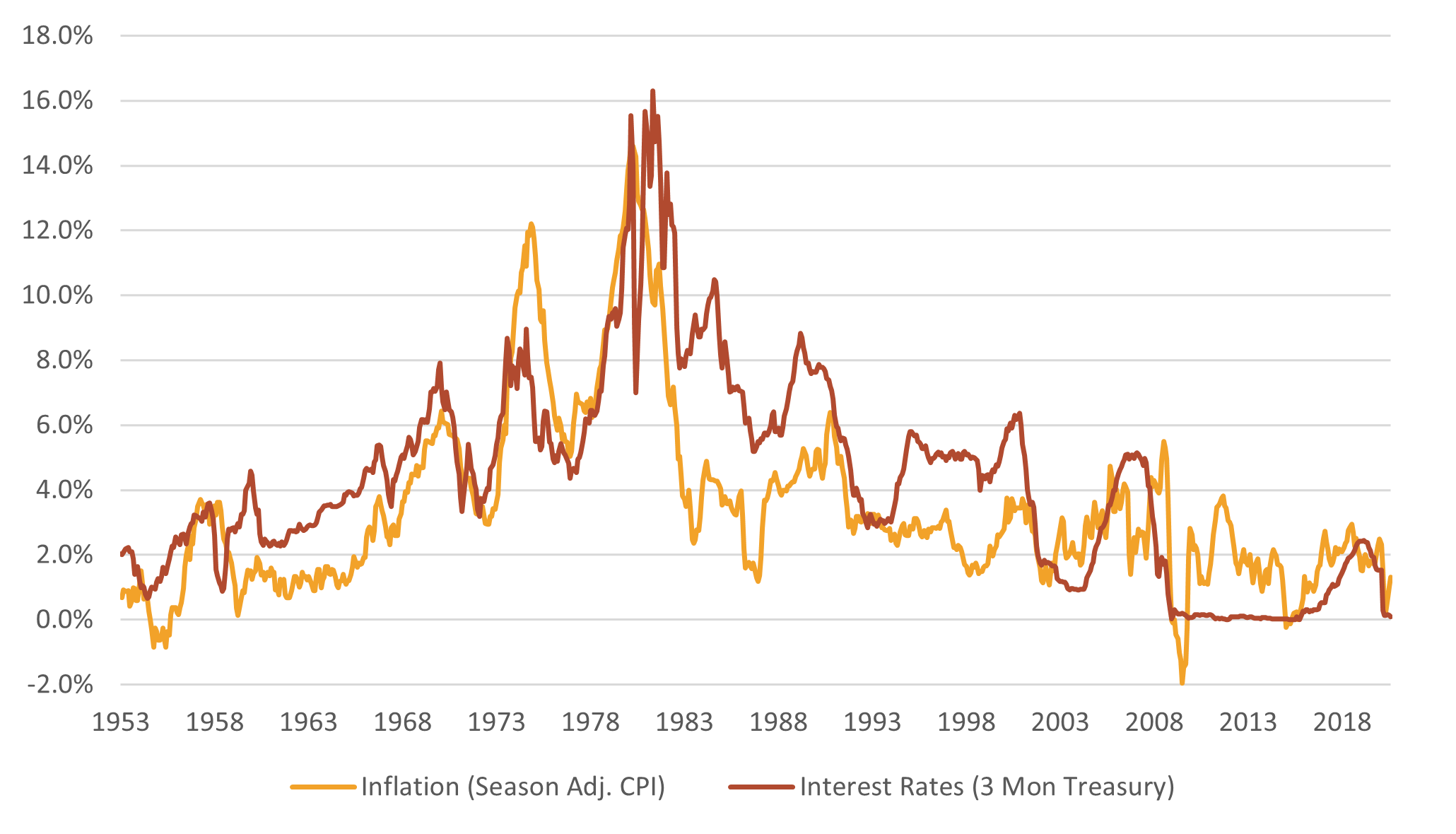

As of September 30, 2020, the Fed projects inflation to average 1.79% over the next five years, close to the long-run target of 2.00%.[1][3] As illustrated in the graph below, the Fed has worked over the past 50+ years to influence (primarily to decrease) inflation to that 2.00% goal, significantly through affecting interest rates.

Sources: Morningstar, FRED, as of 30-Sep-2020. Interest Rates: 3-Month Treasury Bill: Secondary Market Rate (TB3MS); Inflation: Consumer Price Index for All Urban Consumers: All Items in U.S. City Average (CPIAUCSL).

Generally (all else equal), as interest rates decrease, prices of existing bonds increase, partially because of increased investor demand for higher-yielding investments. Much of the strong returns for US bonds over the past 40 years is due to positive price changes caused by generally declining interest rates.[4]

However, since expected inflation is now near the long-term target, we think it is reasonable to expect that interest payments, not price changes, will drive the majority of positive bond returns over the next 10+ years, and that interest rates will remain near current levels. This provides significant justification for why SJS projects a 2.50 – 3.50% return for US aggregate bonds over the next 10+ years (as further detailed in the SJS 2020 Capital Market Expectations). Using these return expectations as part of the MarketPlus Investing approach allows SJS to help clients develop portfolios designed to meet their current and future needs.

If you would like to talk about how inflation and interest rates may impact your lifestyle and investment portfolio, please reach out to us. We are always here to listen and assist.

Important Disclosure Information and Sources

[1] “How does the Federal Reserve affect inflation and employment?“ The Federal Reserve, federalreserve.gov.

[2] “Monetary Policy Actions and Long-Term Interest Rates.“ V. Vance Roley and Gordon H. Sellon, Jr., Q4 1995, kansascityfed.org.

[3] “5-Year Forward Inflation Expectation Rate.“ Federal Reserve Bank of St. Louis, 30-Sep-2020, fred.stlouisfed.org.

[4] “An Appreciation for the Bull Market in Long-Term Bonds.“ Ben Carlson, 16-Aug-2019, awealthofcommonsense.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.