How Should You Donate To Charitable Organizations?

By Investment Associate Bobby Adusumilli, CFA.

Most of us accumulate money in order to support ourselves and our families. We also use our money and resources to make a positive difference for the communities and organizations that we care most about. Research has even found that donating money to a charitable cause is one of the best ways to use money to make ourselves happier.[1] Do good, feel good.

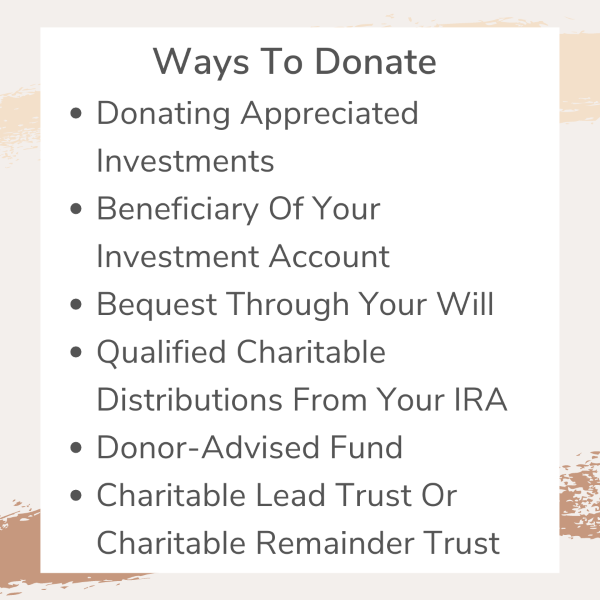

While cash is usually the easiest form of donation, it may not be the best way for you financially. Depending on the situation, some ways make more financial sense than others. Below, we detail a few ways that you can donate to charitable organizations in order to help you determine what strategy would be financially best for you. As always, please work with your tax professional as well as your estate planning professional when developing and implementing your charitable plan.

Donating Appreciated Investments

Whether it's a stock, bond, mutual fund, ETF, real estate, or another investment type, you may be able to donate the appreciated investment directly to the charity. If you have held the investment for more than one year, you can potentially deduct the full market value of your investment from your income taxes for that year, and you may also be able to avoid capital gains taxes.[2] Not all charities can accept all types of investments, so please work with the charity to determine if they can receive an investment you are interested in donating.

Beneficiary Of Your Investment Account

Specifying a charitable organization as your beneficiary on an investment account is one of the easiest ways for you to leave assets for a charity when you pass away. You can specify the charity as a beneficiary to receive a percentage of your investment account in the future, hopefully benefitting from any investment growth over time.[3] Additionally, if the charity is the beneficiary of your Traditional (pre-tax) IRA, then the charity may not have to pay federal income taxes like a child or grandchild may have to.

Your beneficiaries on your accounts typically take priority over bequests in your will, so please ensure that your beneficiaries and bequests in your will are consistent. One potential downside for this option is that depending on how you have set up your finances, your financial assets may need to go through the probate process, which can be complicated and time-intensive.

Bequest Through Your Will

Through bequests, you can use your will to help specify where your assets will go when you pass way. Some common types of bequests include:[4]

General Bequest: You specify a sum of money to be donated to the charity.

Percentage Bequest: You specify a percentage of your estate to be left to the charity.

Specific Bequest: You specify that a particular asset that you own is left to the charity, such as real estate or an investment.

Residuary Bequest: Once all other bequests have been satisfied, the charity receives some percentage of your estate.

If you choose to leave a bequest in your will, it is important to work with an estate professional.

Qualified Charitable Distributions From Your IRA

A Qualified Charitable Distribution (QCD) allows someone age 70 1/2 (earlier than the RMD age of 72) or older to make donations directly from your IRA to an eligible charity. Each eligible person can donate up to $100,000 per year in QCDs, which can count towards your required minimum distribution (RMD). By donating directly from your IRA, you avoid increasing your adjusted gross income, and a QCD will not cause your Social Security income to be subject to more taxes.[5] Some IRA administrators may charge a fee or have other limitations for QCDs, so please work with your IRA administrator to determine whether you can complete a QCD.

Donor-Advised Fund

A donor-advised fund (DAF) is an account you establish at a community foundation or a qualified custodian like Schwab Charitable. You make an irrevocable contribution of assets (such as cash, stocks, bonds, or real estate) to the DAF, for which you may be able to receive an immediate tax deduction. You may be able to keep the asset as is within the DAF, or you can sell the asset and invest in a selection of investments (often mutual funds and ETFs) offered on the public charity’s platform. You can elect for the DAF to make contributions to your intended charity on a timeline you specify. A DAF can help you ensure that the money will go towards your intended charity both while you are living as well as after you pass away, though DAFs typically have an annual fee. Some donor-advised platforms have limitations on what types of assets they can accept as donations and to which charities they will donate to.[6]

Charitable Lead Or Charitable Remainder Trust

A charitable lead trust is an irrevocable split-interest trust in which a charity receives proceeds from the trust during its life, and other non-charitable beneficiaries receive remaining assets once the trust terminates.[7]

A charitable remainder trust is an irrevocable split-interest trust in which non-charitable beneficiaries receives proceeds from the trust during its life, and a charity receives remaining assets once the trust terminates.[7]

If properly implemented, these trusts can have tax advantages for you. Creating and implementing these trusts usually entails significant fees, and it is important to work with an estate professional.

Conclusion

Donating can help you leave a positive impact on the world. By controlling what you can ahead of time through thoughtfully implementing your charitable plan, you can increase the chances that the money makes it to your intended charitable organizations. If you have any questions or want to discuss which charitable planning strategies may make sense for you, please feel free to reach out to us.

Important Disclosure Information & Sources:

[1] “Happy Money: The Science of Happier Spending”. Elizabeth Dunn & Michael Norton, 2014, Simon & Schuster.

[2] “Benefits of Donating Appreciated Non-Cash Assets to Charity“. Schwab Charitable, 21-May-2020, schwabcharitable.org.

[3] “Naming a Charity as a Beneficiary“. Trust & Will, trustandwill.com.

[4] “What are bequests?“ Fidelity Charitable, fidelitycharitable.org.

[5] “How to Reduce Your Taxes and AGI by Giving to Charity“. Mark P. Cussen, 08-May-2022, investopedia.com.

[6] “What is a Donor-Advised Fund (DAF)?“ National Philanthropic Trust, nptrust.org.

[7] “How to donate to charity in your will“. Thrivent, 31-May-2022, thrivent.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.