Bond Returns – Could The ‘Drought’ Be Ending?

By SJS Director of Institutional Investment Management Kirk Ludwig

Whether you’re an SJS client living in Ohio or Arizona – or somewhere in between – chances are good that you have experienced an environmental drought at some point during your lifetime.

In the bond market, we have been experiencing our own version of a “drought” over the past decade – a shortage of income (or, yield) from our bonds, with respect to the fixed income allocations in our MarketPlus® portfolios. A drought begins and intensifies when there is a continued shortage of rainfall. Over time, the ground dries up. The “green” goes away as plants, shrubs, and trees die or fall dormant. The ground remains fertile but, in the absence of precipitation to generate new growth, crops fail to produce their yield.

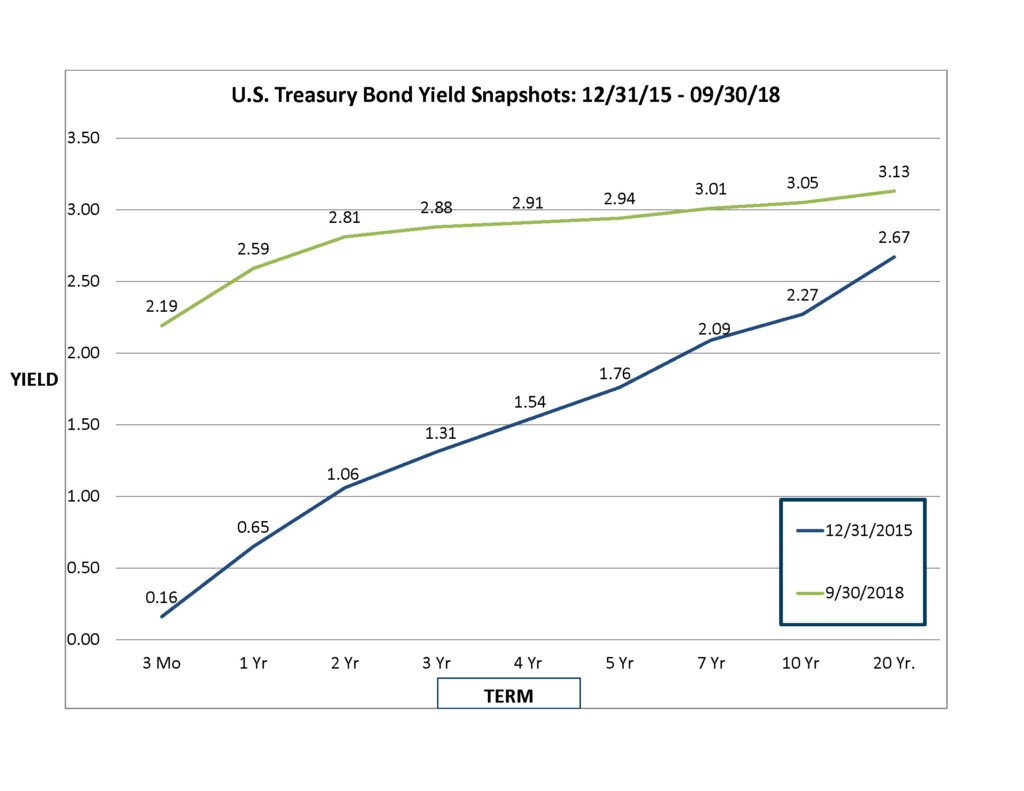

Typically, we think of bonds, or fixed income, as the “safer” part of our portfolios, since they generate income while providing portfolio stability. However, since the Great Recession in 2007, short-term bond rates have hovered near zero percent, evaporating any income from this part of the portfolio.[1] Now that the U.S. economy is feeling more stable, the Federal Reserve has increased their target rate to 2.25%, which in turn has showered the bond market with a much needed income boost.[2]

Similar to how a gentle rainfall would not immediately end a weather drought, a gradual increase in interest rates doesn’t automatically lead to higher income. When interest rates go up, the principal value of a bond will actually adjust lower to make up for the higher market rate. This adjustment period often dampens fixed income returns in the short-term, but leads to a higher income stream in the future. As a result, the returns in fixed income investments year-to-date in your portfolio have been fairly flat.

We are eager to start capturing greater yields, but we have to be patient. In the current interest rate environment, the bond portion of our MarketPlus portfolios will gradually start capturing the increase in rates as shorter-term bonds mature and proceeds are reinvested at today’s higher yields. The Federal Reserve will likely continue to raise short-term rates in the near future, which means bond returns may continue to be flat for a while. However, we believe that we will soon start to see evidence of higher yields as they sprout within the portfolios.

A recovery following a drought is gradual. It doesn’t happen like a flood – instantly inundating. The recovery occurs by having a steady, soaking rain for a few days or more. Before you know it, your resources are recovering and the drought has ended.

Our hope is that our client portfolios start to benefit from these drought-ending rate increases, and that their future “harvest” will be more bountiful.

Sources:

[1] Daily Treasury Yield Curve Rates, U.S. Department of the Treasury.

[2] U.S. Rates and Bonds, Bloomberg.com.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.