SJS Weekly Market Update

SJS Investment Services creates a weekly market update to summarize performance characteristics for major stock and bond indices.

Student Shadow Program Builds Financial Literacy Skills

This winter, we had the pleasure of hosting two students from Northview High School through our six-week financial literacy student shadow program in our Sylvania, Ohio office.

SJS Book Club: Why Small Habits Matter for Investing, Retirement, and Life

At SJS, we often talk about what it means to build a better life. While investing and financial planning play an important role, we know the foundation of a better life is much broader than simply making sound financial decisions. Living a more meaningful life often starts with small, consistent habits.

Stay On Target

Every January, Wall Street releases its newest flurry of S&P 500 year‑end predictions. And inevitably, we’re asked where we think the market is headed. At SJS, we certainly have opinions, but we don’t publish short-term market forecasts or build client portfolios around them. Because, quite simply, no one knows where markets will land. Not us, not the loudest voices on TV, and not even the banks that publish those targets with great confidence.

Don’t Let Bubble Talk Burst Your Plan

Are valuations excessively high? Do record earnings justify selling? Headlines that stir fear are not new. Investors often get caught up in market noise, but recognizing that news headlines are often written to prioritize clicks over nuanced truth can reduce stress.

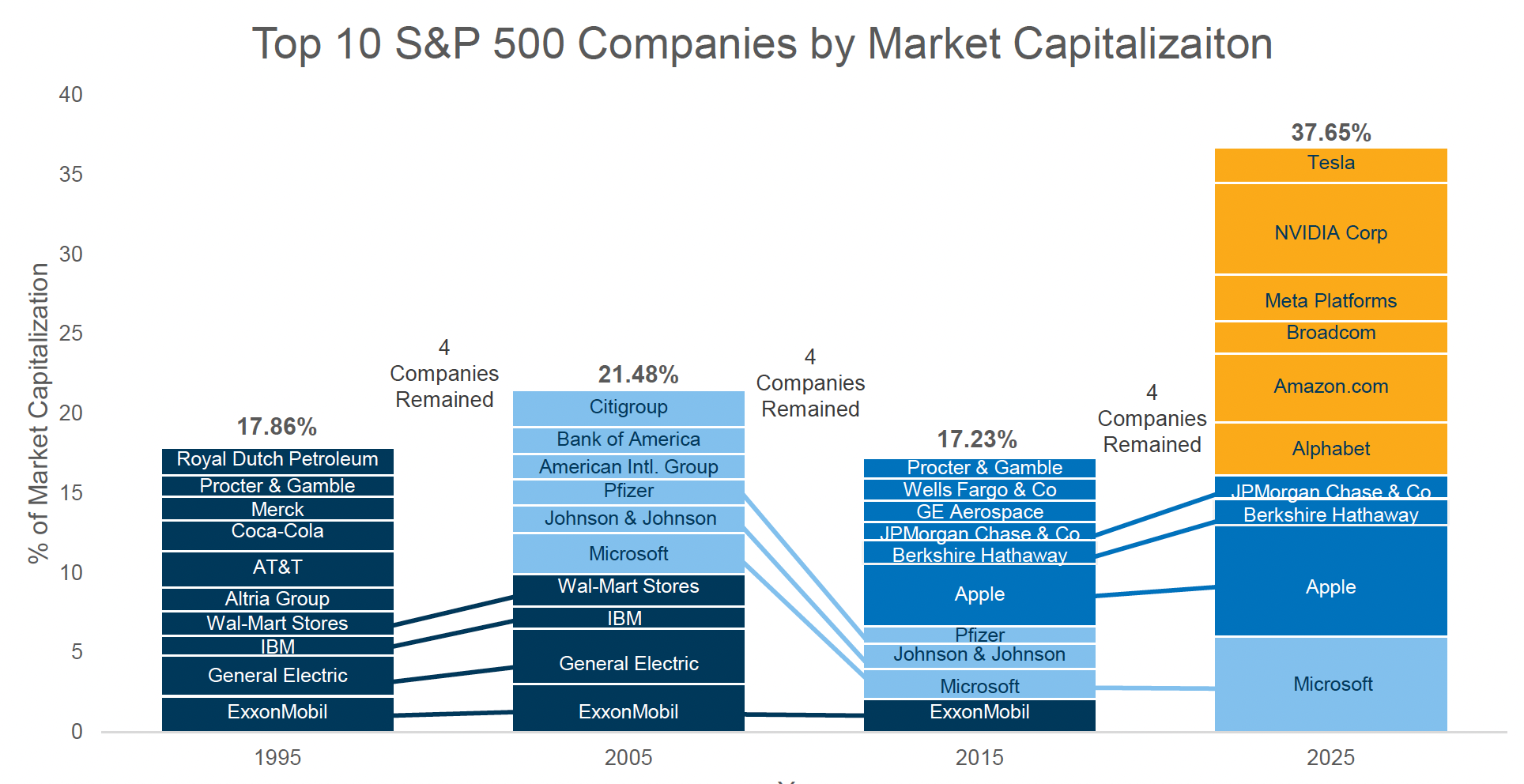

AOL to AI: How Innovation Keeps Reshaping Market Leadership

Do you remember when AOL was the internet? When hearing “You’ve got mail” felt like a small event, and logging on meant you were connected to the future?

Your Wealth in 2026: New Year, New Limits

The beginning of 2026 is a natural checkpoint to make sure your saving, gifting, and protection strategies still match the life you are living today. Your financial planning can benefit from a fresh look at the start of each year and we have a some actionable ideas to start the new year on the right foot, financially.

Roaring Returns: 2025 Market Recap and Outlook

2025 closed out with global stock markets delivering another remarkable year, capping one of the strongest three-year stretches in stock market history. The April correction now feels like a distant memory as tariff shocks came and went.

Imagine Peace of Mind

As we excitedly look forward to the year ahead, we remain deeply committed to empowering you to build a better life and providing the peace of mind you deserve.

SJS Quarterly Report – January 2026

Each quarter, we create an outlook that covers topics including general investment market conditions, financial planning considerations, and SJS news.

Thank You Isaac Saffold!

This fall, we had the pleasure of working with Isaac Saffold, an intern from Georgetown University. Isaac joined us through a meaningful connection — he was referred by the Georgetown football coach, as SJS Senior Advisor Andrew Schaetzke also played on the team. It’s a great example of how strong relationships open doors and create opportunities.

Important Financial Planning Numbers For 2026

As you look ahead to 2026, it’s easy to feel overwhelmed by all the new financial and tax updates. To make things simpler, we want to highlight the key numbers to keep on your radar this year.

What's The (Gold) Rush?

Gold has delivered eye-catching gains in recent years, surging past $4,000 per ounce this year and headlining financial media with talk of safe havens, inflation fears, and geopolitical uncertainty. This performance has increased investor enthusiasm, but history and research suggest caution.

The Power of Moments: Creating Meaningful Experiences in Life and Wealth

At SJS Investment Services, we believe the client experience is about more than numbers on a page. Our mission is to empower you to build better lives. Recently, our internal SJS Book Club explored The Power of Moments by Chip and Dan Heath, a book that examines why certain experiences stand out — and how we can intentionally create more of them for our clients, colleagues, and communities.

SJS Book Club: The Good Life

Our purpose at SJS is to empower you to build a better life. What a better life–a good life–means varies from person-to-person. While our focus is on finances and investments, our purpose extends far beyond money.

To more deeply understand what a better life entails, the SJS Book Club recently read The Good Life: Lessons from the World's Longest Scientific Study of Happiness by Robert Waldinger and Marc Schulz.

SJS Investment Services Recognized In CNBC's 2025 FA 100 List

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

A Cautionary Tale of Concentration & Exuberance

The value of investment markets lies in the unknowable future. No one knows exactly what comes next - despite what some may claim. What we do know, grounded in academic research, is that valuations matter.

Am I Eligible For Medicare & How Do I Enroll?

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services Recognized In The Forbes / SHOOK 2025 List Of America's Top RIA Firms

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Quarterly Outlook: October 2025

In this Outlook, we share an update on today’s markets and the new “Big Beautiful Bill,” plus stories about our SJS Book Club, new team members, and interns.